The Compass

Sanjula Jain, Ph.D. | July 30, 2023Quantifying Share of Care Is a Crucial Aspect in Understanding Patients as Consumers

Key Takeaways

-

With the entry of consumer-focused companies like Amazon and CVS in the healthcare delivery market, health systems need to enhance their data utilization capabilities to comprehend patients' behavior, decision-making processes and, most importantly, engagement with competing healthcare providers.

-

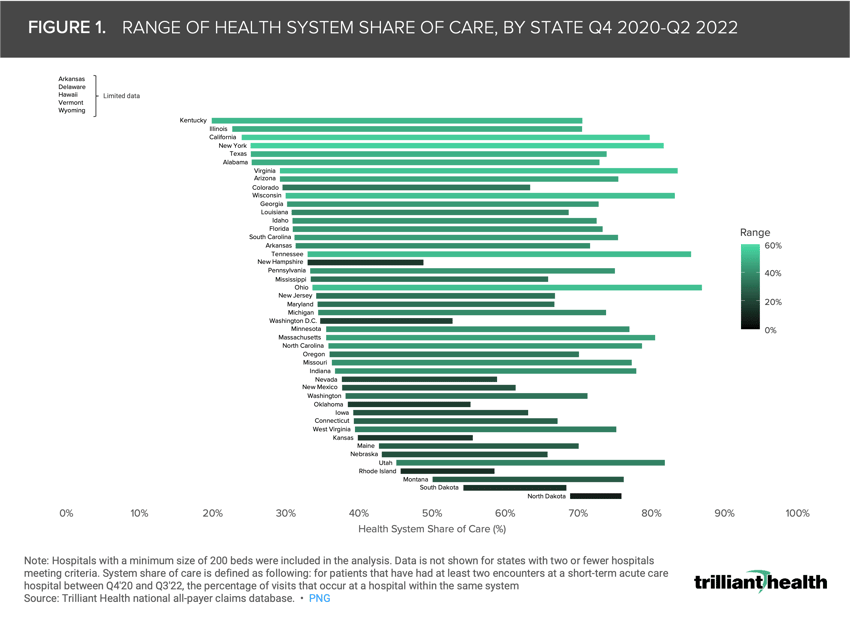

Nationally, health system share of care varies widely, spanning from 19.9% to 86.9%.

-

At the state level, North Dakota demonstrates the most narrow range in share of care, with values ranging from 68.8% to 75.9%. Conversely, New York exhibits the broadest range in share of care, with values ranging from 25.1% to 81.6%.

Traditional measures employed by health systems to attract and retain patients are inadequate for accurately understanding or predicting patient behaviors. Metrics like NPS (Net Promoter Score), HCAHPS (Hospital Consumer Assessment of Healthcare Providers and Systems) and Press Ganey surveys lack reliability in determining patients' future actions. To effectively adapt to the evolving healthcare landscape, health systems must analyze actual patient behavior and incorporate these data into strategic planning. With the entry of consumer-focused companies like Amazon and CVS in the healthcare delivery market, health systems need to enhance their data utilization capabilities to comprehend patients' behavior, decision-making processes and, most importantly, engagement with competing healthcare providers.

Background

Patient loyalty to a single provider network has declined among Americans as the availability of diverse options for low-acuity care, including telehealth, retail clinics, urgent care and primary care offices has increased. On average, patients divide their care across four provider networks annually.1 To compete effectively with new healthcare providers, particularly several Fortune 50 retailers, requires that health systems and traditional provider organizations understand how consumers navigate the healthcare system. This entails gaining insights into their decision-making processes, motivational factors and how, where, and why they engage with the broader healthcare system.

Before health systems can truly develop consumer-focused strategies, they must first establish a foundational understanding of their "share of care" within the markets they operate in.

Defining and Understanding Share of Care

Consumer-facing organizations in industries other than healthcare do everything possible to understand the economic factors affecting their businesses, including knowing their total addressable market, market share for certain products or services, market value and how to acquire market share from the competition. Health systems cannot accomplish this as easily given the lack of visibility into patient behaviors outside of their health system. However, health systems can gain insights into their share of care within the markets they serve through leveraging robust healthcare data. Share of care measures market share based upon the percentage of all care interactions of a patient or patient cohort with a particular health system.

Calculating share of care requires health systems to leverage both internal and external data sources. Internal data sources include patient journey data across care settings and individual electronic medical records. External data sources encompass local U.S. Census data, benchmarks, and indicators of care leakage by payer type. Claims clearinghouses present a valuable resource, offering rich raw data across payers and provider types. Although lacking context without the inclusion of consumer data, the application of machine-learning algorithms to aggregated claims data can help health systems determine their share of care and evaluate network performance.

Analytic Approach

We examined the range of health system share of care for a subset of U.S. short-term acute care hospitals using national all-payer claims data. The analysis included hospitals with a minimum size of 200 beds, and data for states with two or fewer hospitals meeting the criteria was excluded. Health system share of care was determined as the percentage of visits that occurred within the same hospital system for patients who had at least two encounters at a short-term acute care hospital between Q4 2020 and Q3 2022.

Health system share of care is a metric underlying the Competitive Index of our recently released 2023 SimilarityIndex™ | Hospitals.

Discussion

Nationally, health system share of care varies widely, spanning from 19.9% to 86.9% (Figure 1). At the state level, North Dakota demonstrates the most narrow range in share of care, with values ranging from 68.8% to 75.9%. New York exhibits the broadest range in share of care, with values ranging from 25.1% to 81.6%.

Understanding the total addressable market and patient behaviors are crucial to inform strategic investment decisions and capital allocation. Many health systems have invested in specific access points such as telehealth and urgent care, believing that the "front door" to care will engender loyalty for all of a patient’s future care needs. However, longitudinal patient journey data reveal that this assumption rarely holds true. Recognizing this reality can significantly impact service line and investment decisions made by health systems.

Data fragmentation and the lagging progress of interoperability initiatives hinder health systems' access to such valuable information. Electronic medical records, although informative, consistently fail to capture patient interactions occurring outside a health system's network. Nonetheless, in an era where healthcare consumers have more care options than ever before, including new market entrants like CVS and Amazon, the power of knowledge through longitudinal data remains the most potent tool at the disposal of health systems to understand patient behavior.

As healthcare delivery grows increasingly competitive, health systems must not only become data-driven but also align themselves with measures specific to healthcare consumers. Only by leveraging consumer-focused information can health systems effectively compete for patients' share of care in an environment where the supply of services surpasses the current demand for them.

Thanks to Katie Patton for her research support.

- Healthcare Consumerism

- Patient & Provider Loyalty

- Quality & Value

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study and more leading research on the health economy, subscribe to Compass+.

Sign Up for Compass+