The Compass

Sanjula Jain, Ph.D. | September 24, 2023Learnings from the Trends Shaping the Health Economy Report Series: A Review of the Fundamentals

When I launched The Compass in May 2021, I set out to study healthcare trends using the laws of economics – supply, demand and yield – as a conceptual framework because, for decades, the U.S. health economy has operated as if the fundamental rules of economics did not apply. In parallel with the launch of The Compass, we began to develop the data stories for our most comprehensive research publication, Trends Shaping the Health Economy.

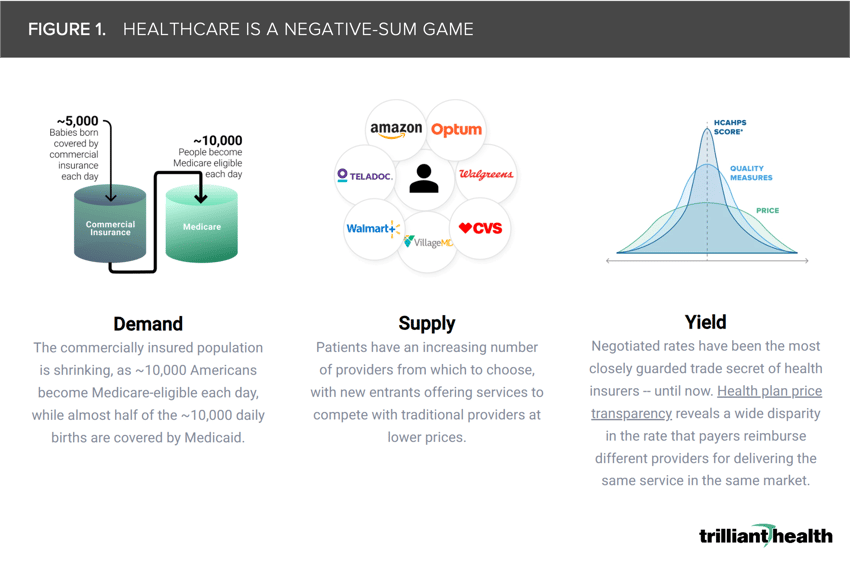

The inaugural 2021 Trends Shaping the Health Economy Report compiled over 120+ discrete data stories, which concluded that healthcare is a negative-sum game. Building on this theme, the 2022 Trends Shaping the Health Economy Report took a closer look at the various demand and supply dynamics affecting healthcare which led to the conclusion that every part of the health economy – from payers and providers to pharma and new entrants – will be impacted by reduced yield.

Next week, we will release the third installment of the Trends Shaping the Health Economy series. Our conclusions from 2021 and 2022 are foundational to analyze and interpret the ten secular trends identified for 2023.

Healthcare is a negative-sum game

While game theory is infrequently, if ever, discussed in our industry, nothing will have a more profound effect on the direction of the health economy over the next 20 years.

There is no way to win a losing game without competing, but there are a few ways to compete seriously: winning key battles, cutting losses early, losing less frequently and losing by a smaller margin than the competition. However, winning more or losing less than the competition is virtually impossible without accurate and actionable information. Ultimately, winners going forward will be those that start playing by the immutable rules of a negative-sum game.

The 2021 findings emphasized the following:

- Demand for healthcare services is flat to declining;

- Healthcare supply is plentiful and growing; and

- To compete in a low demand, high supply economy, price is a critical lever.

Our thesis is that any health economy stakeholder whose business depends on commercially insured patients can no longer afford to overlook these immutable economic principles. Why? Because the healthcare system is what game theorists call a “negative-sum game,” whereby the costs invested into the system largely outpace the actual value or benefits received by patients or consumers. Operating in a negative-sum game means that every stakeholder will still lose in comparison to what they currently have or really need.

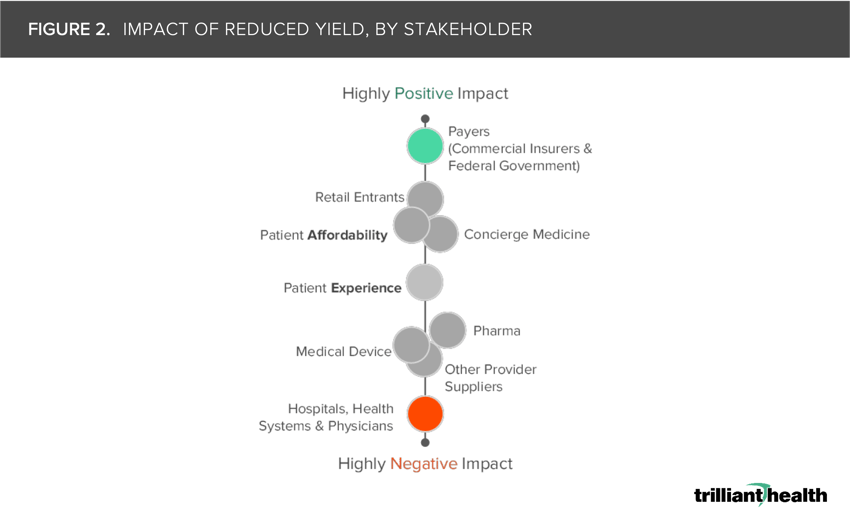

Every part of the health economy will be impacted by reduced yield

The outpacing of supply in contrast to the flat to declining demand – which does not correlate to burden of disease – will continue to contribute to a reduced yield, which most if not all stakeholders are currently not prepared for.

Nationally, healthcare utilization has settled slightly below pre-pandemic volumes, care is shifting from the inpatient to outpatient settings, there are more new healthcare entrants than ever before and patients are facing high deductibles and out-of-pocket costs in an uncertain economy. Due to the combination of these factors, the average patient is interacting with the healthcare system in a different way. As rising healthcare unaffordability becomes a greater concern for Americans in tandem with declining U.S. life expectancy, how much longer can the health economy get away with defying the laws of economics? In the words of the economist Herb Stein, “if something cannot go on forever, it will stop.”

Healthcare spending accounts almost 20% of U.S. GDP. The prices that commercial health insurers pay are much higher and are rising more quickly than the prices paid by public insurance programs. The Congressional Budget Office has developed a framework for how Federal legislation might address high commercial prices, which result from negotiations between private payers and hospitals or physician groups. While two of the three policy options are familiar to health economy stakeholders — promoting price transparency and provider competition — the third policy option to limit commercial prices is one that would dramatically change the game for every stakeholder.

Every stakeholder must consider and prepare for the implications of reduced yield in a post-pandemic health economy. While every stakeholder would be affected, payers will inevitably come out on top relative to others.

In a negative-sum health economy defined by reduced yield, the only way to “lose less” is to compete on value.

More to come next week…

- Cost of Care

- Quality & Value

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+.

Sign UpSee more with Compass+

You are currently viewing the free version of this study. To access the full study and more leading research on the health economy, subscribe to Compass+.

Sign Up for Compass+