Studies Archive

Analyzing Planned and Executed Hospital M&A Transactions with SimilarityIndex™ M&A Scores

August 6, 2023Key Takeaways

-

Following three years of hospital M&A trending downward, 2022 saw an uptick in deal volume compared to 2021.

-

The more similar hospitals are based on markets, financial and competitive metrics, the higher probability that the merged system will continue with the established “playbook” and fully integrate (i.e., the merger will play to their strengths).

-

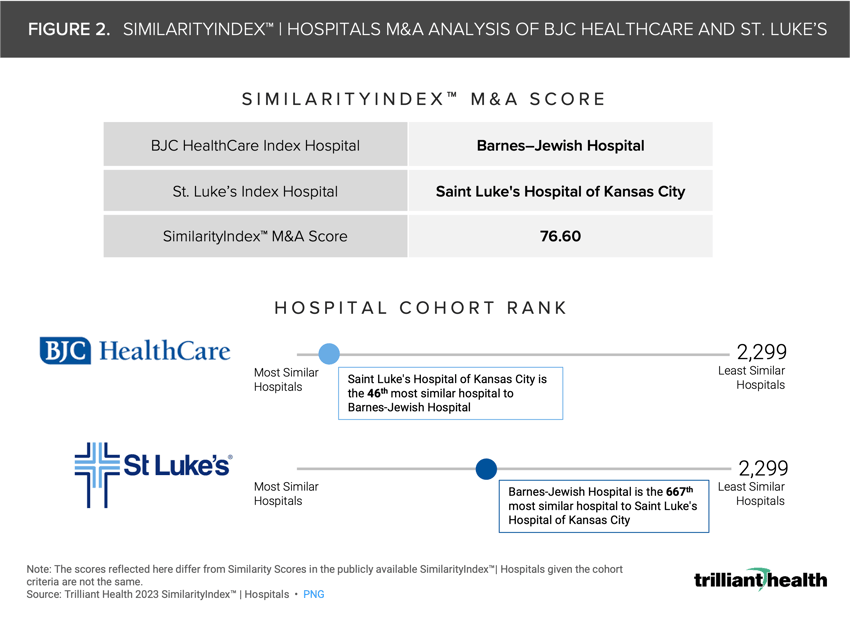

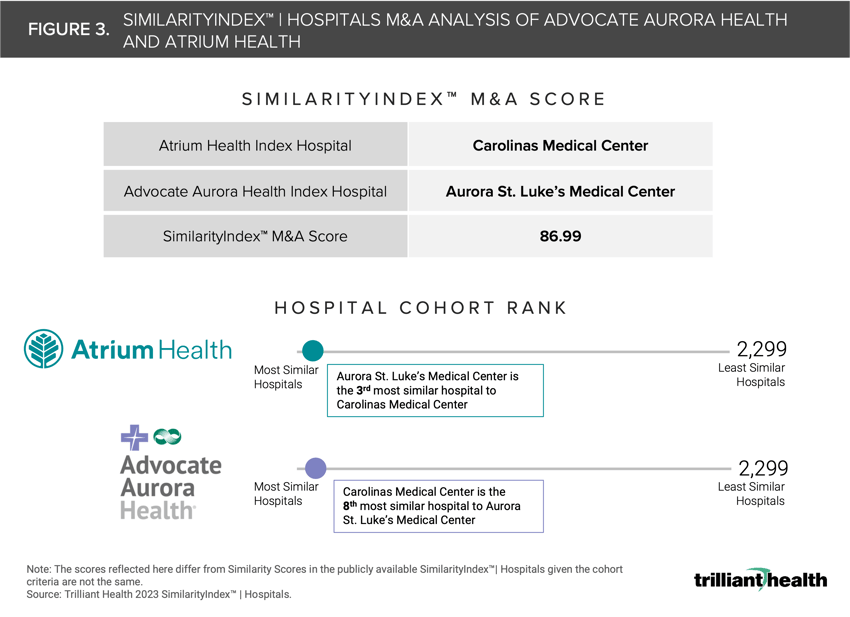

Analysis of two recent transaction announcements reveals Atrium Health and Advocate Aurora have a SimilarityIndex™ M&A Score of 86.99; whereas St. Luke’s and BJC Healthcare have a SimilarityIndex™ M&A Score of 76.60.

-

A higher SimilarityIndex™ M&A Score is indicative of greater likelihood of alignment post transaction.

Following three years of hospital merger and acquisition (M&A) trending downward, 2022 saw an uptick in deal volume compared to 2021. The renewed hospital M&A activity comes despite increasing scrutiny from the Federal Trade Commission (FTC) and continued conflicting outlooks around the impact of M&A on cost and quality.1,2,3 Additionally, the Department of Justice (DOJ) and FTC recently proposed revised guidelines that would likely lead to increased scrutiny of healthcare transactions—particularly for hospitals.4

Background

Between 2012 and 2019, while the number of announced hospital and health system transactions exceeded 90 annually, those totals began to decline amid the COVID-19 pandemic, with only 48 announced transactions in 2021.5 However, the number of deals increased to 53 in 2022—one-third of which were announced in Q4 2022. While several 2022 transactions are notable in terms of deal size and market impact, the recently completed Advocate Aurora and Atrium Health deal is especially important given that the newly formed “Advocate Health” is now the fifth largest nonprofit integrated U.S. health system—totaling 67 hospitals, 21,000 employed physicians, and generating over $27B in revenue. In 2023, Kaiser Permanente announced it would be acquiring Geisinger, forming “Risant Health” pending regulatory approval.6

Such noteworthy M&A activity begs the questions of how targets are identified, what metrics are being taken into account, whether regulatory approval will be granted and how viable the merged systems will be.

Analytic Approach

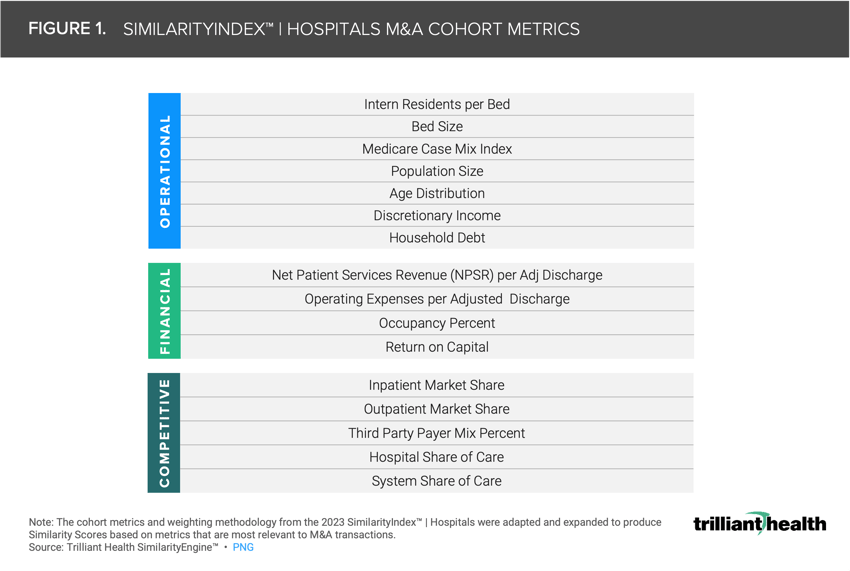

To study this further, we leveraged the Trilliant Health SimilarityEngine™ and 2023 SimilarityIndex™ | Hospitals to analyze several recently announced M&A transactions. In theory, competitive and financial metrics are critical in healthcare M&A strategy, in addition to market dynamics and service mix. Therefore, we adjusted the weighting and methodology of SimilarityIndex™ | Hospitals to produce Similarity Scores based on metrics that are most relevant to M&A transactions. Similarity Scores are bound between 0 and 100, with a value closer to 100 reflecting greater similarity to the benchmark hospital.

In adjusting the factors for determining peer cohorts specific to M&A activity, we included greater emphasis on financial metrics (i.e., occupancy, return on capital) and competitive metrics (i.e., third-party payer mix) in addition to the standard control metrics (e.g., bed size). The more similar these hospitals are based on markets, financial and competitive metrics, the higher probability that the merged system will continue with the established “playbook” and fully integrate (i.e., the merger will play to their strengths). The more dissimilar these hospitals are, the more probable that these systems will merge in name only and have a more difficult time fully integrating.

For this analysis, we studied two recent health system transactions—BJC Healthcare and Saint Luke’s Health System, announced earlier this year, and Advocate Aurora and Atrium Health, which was finalized at the end of 2022.

Discussion

On May 31, 2023, BJC HealthCare and Saint Luke's Health System signed a letter of intent to form an integrated Missouri-based health system. To assess the degree of similarity between the two health systems, we conducted an analysis of the largest hospital in each system—St. Luke’s Kansas City and Barnes-Jewish Hospital. The analysis reveals that St. Luke’s Kansas City and Barnes-Jewish Hospital have a SimilarityIndex™ M&A Score of 76.60, or a distance of 23.4 (Figure 2). Said differently, using Barnes-Jewish Hospital as the index hospital, St Luke’s Kansas City is its 46th most similar hospital out of the 2,299 hospitals in the national analysis.

In December 2022, Advocate Aurora Health and Atrium Health finalized their combination to form a 67-hospital system. Similarly, we conducted an analysis of the largest hospital in each system—Carolinas Medical Center and Aurora St. Luke’s Medical Center. The analysis reveals that Atrium and Advocate Aurora have a SimilarityIndex™ M&A Score of 86.99, or a distance of 13.01 (Figure 3). Said differently, using Carolinas Medical Center (Atrium) as the index hospital, Aurora St Luke’s Medical Center is the third most similar hospital out of the 2,299 hospitals in the national analysis.

In addition to these two examples, we also studied the similarity of several other announced 2023 transactions. The findings of these analyses and corresponding downloadable charts can be accessed through the Compass+ platform.

A higher Similarity Score is indicative of greater likelihood of alignment post transaction. This analysis suggests there are several other hospitals that are operationally, financially and competitively more similar from an evidence-based perspective in the BJC and St. Luke’s transaction, but more alignment in the Atrium and Advocate Aurora transaction. Not only do the hospitals analyzed in the Advocate Aurora and Atrium Health example have a high Similarity Score of 86.99, but the hospitals are also among the 10 most similar to each other, indicating a high degree of financial and operational similarity.

With so much scrutiny on horizontal integration from a regulatory perspective, healthcare stakeholders—particularly health systems—could benefit from applying similarity metrics in their decision-making process.

Thanks to Amanda Cole, Dean McKee and Katie Patton for their research support.

- Healthcare Investments & Partnerships

- Quality & Value