Counterpoint

Hal Andrews | January 12, 2021Winning a Losing Game, Healthcare Edition

Poker players know that if you sit down at the table and cannot figure out who the "mark" is, then it is you.

Health system executives don’t have to wonder. In a world of payer consolidation, new market entrants, technology, alternative payment models, changing federal and state regulations, pharmaceutical innovations, benefit plan design, and consumer choice, hospitals and health systems have been dealt the worst hand. Now, more than ever, hospitals and health systems need to grow revenue and increase market share by successfully acquiring net new patients while keeping their existing patients loyal.

Since Benjamin Franklin co-founded Pennsylvania Hospital in 1751, hospitals and health systems have invested significant resources in training executives to focus on the activities inside the four walls of the hospital, which Peter Drucker described as “altogether the most complex human organization ever designed.”[1] This historic focus on the physician as the hospital’s customer has persisted for decades because consumers have not objected to being treated as “patients” by hospitals and physicians. In fact, patients have faithfully followed doctors’ orders, particularly with respect to referrals for services. Assuming that patients will follow doctors' orders is no longer sufficient; neither is believing that physicians are referring all of their cases to you.

Irrespective of healthcare policy, healthcare economics continue to incentivize the migration of healthcare services delivery from inpatient to outpatient settings. According to research by Deloitte, outpatient revenue as a percentage of total hospital revenue has increased from 28% in 1994 to 48% in 2018.[2] More importantly, according to 2018 data from the American Hospital Association, both inpatient and outpatient hospital volumes gradually declined from 2017 to 2018, which has not happened since 1983.[3] This trend will accelerate as the Centers for Medicare and Medicaid Services (CMS) increases the number and type of surgeries that can be performed in outpatient settings and eliminates the “inpatient only” list by 2024.[4] The pandemic has also forced shifts in behavior with consumers increasingly seeking outpatient settings out of fear of contracting SARS-CoV-2 from a hospital visit.

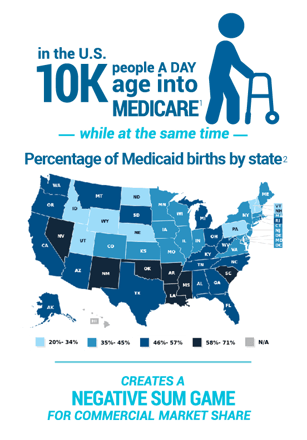

What is required to operate a thriving healthcare system in the United States has changed since 1751, if slowly. For decades, hospitals have relied on revenue from commercially insured patients to subsidize the losses from caring for Medicare, Medicaid and charity patients. Unfortunately, the number of commercially insured patients inexorably decreases, with the ~10,000 citizens who become Medicare eligible every day being “replaced” by the 10,388 average daily births, the majority of which are financed by Medicaid.[5],[6],[7]

What is required to operate a thriving healthcare system in the United States has changed since 1751, if slowly. For decades, hospitals have relied on revenue from commercially insured patients to subsidize the losses from caring for Medicare, Medicaid and charity patients. Unfortunately, the number of commercially insured patients inexorably decreases, with the ~10,000 citizens who become Medicare eligible every day being “replaced” by the 10,388 average daily births, the majority of which are financed by Medicaid.[5],[6],[7]

Healthcare systems need to respond to today’s challenges, and today’s most pressing challenge is this:

The hospital business is a negative-sum game.

Game theory is infrequently, if ever, discussed in healthcare systems, but nothing will have a more profound effect on the performance of America’s hospitals in the next 20 years.

“The most difficult problems are negative-sum situations, where the pie is shrinking. In the end, the gains and losses will all add up to less than zero. This means that the only way for a party to maintain its position is to take something from another party, and even if everyone takes his or her share of the "losses," everyone still loses in comparison to what they currently have or really need. This type of situation often sparks serious competition.”[8]

There is no doubt that the pie is shrinking for health systems and hospitals. As a result of the pandemic, the Commonwealth Fund projects that almost 15M Americans lost commercial health insurance.[9]

There is no way to win a losing game without competing, but there are a number of ways to compete seriously: winning key battles, cutting losses early, losing less frequently, and losing by a smaller margin than the competition. However, winning more or losing less than the competition is virtually impossible without accurate and actionable information.

Market share is the most important metric to measure wins and losses, so analyzing market share correctly is fundamental to survival. However, most healthcare systems fundamentally misunderstand market share, in large part due to their historic focus on inpatient care. Similarly, most healthcare systems misunderstand the market forces that determine market share.

In reality, much of what healthcare executives refer to as “analytics” is actually benchmarking. For decades, health systems have calculated what happened in the past, compared it to what they believe is true about other hospitals, reported it to the Board of Directors, and then turned back to trying to make the medical staff happy. For decades, health systems have endured without analyzing information and without making data-driven strategic decisions.

Healthcare systems must adapt to survive, much less thrive. In the words of General Eric Shinseki, “If you don’t like change, you will like irrelevance even less.”

Over the next few weeks, we will examine the essentials in winning a losing game for those health systems who understand that change is imperative, as we did in our eBook, Doors are Open but the Beds are Empty: How to Grow Surgical Service Lines when Patients Don't Want to Come to the Hospital.

In this new series, we will offer strategies and tactics to win key battles, lose less frequently, lose quickly, and lose by a smaller margin. Our objective is simple: we believe hospitals are the lifeblood of vibrant communities, and we want you not only to survive but to thrive.

If you have topics, questions or challenges your system is facing that you would like us to address, email us at growth@trillianthealth.com or message us on LinkedIn at Trilliant Health.

Part II: Lessons from Nick Saban on Thinking Like a Champion

[1] Peter Drucker, Classic Drucker: Essential Wisdom of Peter Drucker from the Pages of Harvard Business Review, (Harvard Business School Publishing Corporation), 54.

[2] https://www2.deloitte.com/us/en/insights/industry/health-care/outpatient-virtual-health-care-trends.html

[3] https://www.darkdaily.com/outpatient-visits-to-hospitals-decline-year-to-year-for-first-time-in-35-years-affecting-clinical-laboratories-and-other-in-hospital-services/#:~:text=The%20AHA%20surveyed%206%2C146%20hospitals,0.09%25%20over%20the%20previous%20year.

[4] https://www.cms.gov/newsroom/fact-sheets/cy-2021-medicare-hospital-outpatient-prospective-payment-system-and-ambulatory-surgical-center-0

[5] https://www.kff.org/medicare/state-indicator/total-medicare-beneficiaries/?activeTab=graph¤tTimeframe=0&startTimeframe=8&selectedDistributions=total&selectedRows=%7B%22wrapups%22:%7B%22united-states%22:%7B%7D%7D%7D&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[6] https://www.cdc.gov/nchs/fastats/births.htm

[7] https://www.kff.org/medicaid/state-indicator/births-financed-by-medicaid/?activeTab=map¤tTimeframe=0&selectedDistributions=percent-of-births-financed-by-medicaid&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[8] https://www.beyondintractability.org/essay/sum

[9] https://www.commonwealthfund.org/publications/issue-briefs/2020/oct/how-many-lost-jobs-employer-coverage-pandemic

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)