Counterpoint

Hal Andrews | October 6, 2020The One Thing That HCA and Walmart NEVER Do…

2020 has been full of unpleasant surprises, especially for hospitals and healthcare providers. One thing, however, is unfortunately not a surprise: the number of health systems reporting that they have “cut back” or “eliminated” (gasp) their strategy budgets.

Clichés are clichés because they are true, and this one comes to mind:

“You can’t cut your way to prosperity.”

Logic suggests that failing to invest in growth strategies will be a self-fulfilling prophecy. The reason that there are no case studies at Harvard Business School about companies that succeeded by eliminating their strategy executives and analytics budgets is because that has never happened.

HCA knows this, which is why they never stop investing in growth, even in challenging times. Do they delay capital expenditures? Yes, in some cases. Are they willing to reallocate investment dollars intended for one market to another market based on new information? Yes. Do they reduce spending with consultants? Sometimes, but they already spend less on consultants than most health systems. Do they ever stop thinking about growth? Never. Do they ever stop seeking better data and more data to enable them to develop better strategic plans? Never. Do they ever stop competing for the hearts and minds of physicians? Never.

HCA’s success is largely attributable to strategic decisions made in the 1980s, particularly real estate decisions. Time and time again, in Nashville and Portsmouth, New Hampshire and Austin, Texas and many other markets, HCA made extraordinary decisions about markets and sub-markets and site selection. Most health systems have some basic understanding of how it feels to compete with HCA, and we can quantify it simply: HCA is winning. How health systems believe that they can compete with HCA by cutting strategy budgets brings to mind what Sir Winston Churchill said about Russia: “ It is a riddle wrapped in a mystery inside an enigma; but perhaps there is a key.” Perhaps…

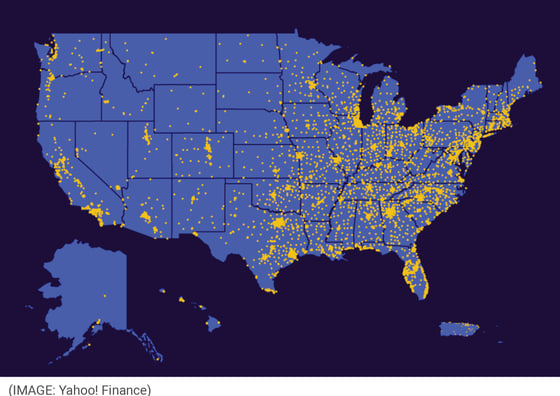

If any company is better than HCA at site selection and data-driven decision-making, then Walmart is that company. Most health systems have no understanding of what competing with Walmart will be like, but we predicted it in 2007. Most people, including a few Walmart executives, did not believe us in 2007, but last week’s announcement has a lot of people trying to get up to speed. In summary:

- By the end of 2020 Walmart Health will have 13 locations in Georgia, two locations in Chicago, and one in Arkansas. In 2021, they plan to expand quickly into the Florida market targeting Jacksonville, Tampa, Orlando. With 90% of the American population living within 10 miles of a Walmart, their expansion will likely impact every single health system in the country.

- Walmart has partnered with Clover to offer Medicare Advantage plans beginning in Georgia.

- All of the services offered have transparent pricing and they accept all major insurance products.

- The United States has 3,141 counties and 4,753 Walmart locations (Walmart map below).

Peter Drucker wrote that the purpose of strategy is to enable an organization to achieve its desired results in an unpredictable environment.[1] Walmart's entrance into primary care and the Medicare Advantage market will radically change the healthcare industry. 2021 promises to be the first year ever, and perhaps the first of many years to come, when health systems are confronted with the smallest number of commercially insured patients in a decade[2],[3], a dominant urban competitor in the most attractive markets, and the largest company in America entering both urban and rural markets. Maybe strategy is not the place to cut…

[1] Drucker, Peter F. Management Challenges for the 21st Century ( New York: HarperBusiness, 1999) p. 43.

[2] https://www.census.gov/data/tables/time-series/demo/health-insurance/historical-series/hic.html

[3] https://www.rwjf.org/en/library/research/2020/05/how-the-covid-19-recession-could-affect-health-insurance-coverage.html

- Opinion