Study Takeaways

- Nutritionist and dietitian patient volume increased 65.8% from 2018 to 2023, with the fastest growth among adults ages 18-29 (100.5%) and 30-49 (82.9%).

- Women accounted for nearly 70% of all patients between 2018 and 2023.

- Visits associated with general counseling and medical advice grew from 22.5% to 31.0% between 2019 and 2023, overtaking obesity and diabetes as the top documented diagnosis.

Nutritionists and dietitians serve an increasing role in disease prevention and chronic disease management, particularly amid broader efforts to address lifestyle- and diet-related conditions such as diabetes, cardiovascular disease and obesity. Once limited to hospital-based consultations or niche wellness programs, these providers are increasingly integrated across inpatient, outpatient and virtual care settings. As demand for nutrition services evolves and reimbursement structures modernize to include them, more research is needed to understand how patients are accessing and using these services.

Background

Registered dietitians and nutritionists are credentialed providers trained in clinical nutrition, lifestyle counseling and disease-specific dietary management. While these providers deliver non-pharmacologic interventions across a wide range of conditions, utilization has historically been constrained by limited reimbursement and challenges in securing referrals from traditional medical providers. Notably, Medicare Part B only covers medical nutrition therapy (MNT) services for diabetes and kidney disease, restricting broader clinical use in older populations, even though more than two-thirds of Medicare beneficiaries are overweight or obese.1,2

However, both provider supply and commercial insurance coverage have expanded over the last decade. The number of registered nutritionists and dietitians in the U.S. has steadily increased – up 76.0% from 2003 to 2023.3,4 At the same time, some commercial and Medicaid plans have begun to cover MNT for a wider range of conditions, including obesity, heart failure and high-risk pregnancies. Meanwhile, reimbursement patterns are shifting, evidenced in Academy of Nutrition and Dietetics surveys, which found a substantial increase in the proportion of MNT services reimbursed by commercial insurers since 2013.5 However, the study also found that nutritionists and dietitians reported low knowledge of billing codes, reimbursement mechanisms and value-based payment models.

Employers and digital health platforms have also played a role, offering nutrition services as part of wellness or chronic condition management programs.6 Notably, private investment is also accelerating in this market. Nourish, a virtual network of registered nutritionists and dietitians, raised $70M at a valuation exceeding $1B.7 Nourish reports improved outcomes among patients on GLP-1 medications when paired with dietitian support – reinforcing that nutrition services may complement obesity and diabetes medications. Similarly, Virta Health, which provides nutrition-based interventions for type 2 diabetes reversal, has demonstrated meaningful clinical outcomes and has secured partnerships with commercial insurers and employers alike.8 Together, these factors raise the question of how broadly these providers are being utilized within traditional insurance arrangements.

Analytic Approach

All-payer claims data were leveraged to analyze patient utilization of services with registered dietitians and nutritionists between 2018 and 2023. Patients were analyzed by gender and age based on the most common diagnoses associated with dietitian and nutritionist visits, together with the most common comorbid chronic conditions.

Findings

From 2018 to 2023, both visit and patient volume for nutritionist and dietitian services increased, with visits increasing by 111.9% and patients increasing by 65.8% (Figure 1). Telehealth utilization of nutritionist services increased drastically from less than 1% in 2018-2019 to 37.7% in 2020, peaking at 41.2% in 2021. Since then, telehealth has stabilized at around 38% of visits.

From 2018 to 2023, patient volume for nutritionist and dietitian services increased across all age groups, with the most pronounced growth concentrated among younger adults. Patients ages 18-29 saw the greatest relative increase, more than doubling (100.5%) compared to 2018, while volume for patients ages 30-49 increased by 82.9% (Figure 2). The sustained growth in the 30-49 age group, which now comprises a third of all nutrition patients, underscores this group’s role as a key driver of utilization.

Between 2018 and 2023, the trend of women utilizing nutritionist and dietitian services at a 2:1 ratio continued, with their share increasing from 65.4% in 2018 to 69.1% in 2023 (Figure 3). While patient volume increased for both groups, female patient volume grew by 75.5% from 2018 to 2023 compared to a 48.6% increase among men. This widening gender gap suggests that women are both more aware of and more likely to utilize nutrition-related care, even as access and insurance coverage have expanded.

Between 2018 and 2023, the trend of women utilizing nutritionist and dietitian services at a 2:1 ratio continued, with their share increasing from 65.4% in 2018 to 69.1% in 2023 (Figure 3). While patient volume increased for both groups, female patient volume grew by 75.5% from 2018 to 2023 compared to a 48.6% increase among men. This widening gender gap suggests that women are both more aware of and more likely to utilize nutrition-related care, even as access and insurance coverage have expanded.

Over time, the share of dietitian and nutritionist visits associated with general counseling and medical advice increased steadily, from 22.5% in 2019 to 31.0% in 2023 (Figure 4). Overweight and obesity remained a leading diagnosis, though its share declined slightly from 24.7% to 23.2% over the same period. Visits related to type 2 diabetes decreased from 18.0% in 2019 to 11.5% in 2023. Eating disorders were associated with 4.9% of visits in 2019, rose to 6.9% in 2021, and slightly declined to 5.9% in 2023. Other diagnoses such as issues with food and fluid intake, lipid disorders, body mass index, high blood sugar, hypertension and type 1 diabetes remained relatively stable, each accounting for less than 3% of total visits in all years shown. While overall utilization is increasing, the slight decline in the share of patients utilizing nutrition services for type 2 diabetes could be influenced in part by the drastic increase in patients using GLP-1 drugs for diabetes and weight loss.

Over time, the share of dietitian and nutritionist visits associated with general counseling and medical advice increased steadily, from 22.5% in 2019 to 31.0% in 2023 (Figure 4). Overweight and obesity remained a leading diagnosis, though its share declined slightly from 24.7% to 23.2% over the same period. Visits related to type 2 diabetes decreased from 18.0% in 2019 to 11.5% in 2023. Eating disorders were associated with 4.9% of visits in 2019, rose to 6.9% in 2021, and slightly declined to 5.9% in 2023. Other diagnoses such as issues with food and fluid intake, lipid disorders, body mass index, high blood sugar, hypertension and type 1 diabetes remained relatively stable, each accounting for less than 3% of total visits in all years shown. While overall utilization is increasing, the slight decline in the share of patients utilizing nutrition services for type 2 diabetes could be influenced in part by the drastic increase in patients using GLP-1 drugs for diabetes and weight loss.

📌 The graph below in interactive. Hover over the dot(s) for more information.

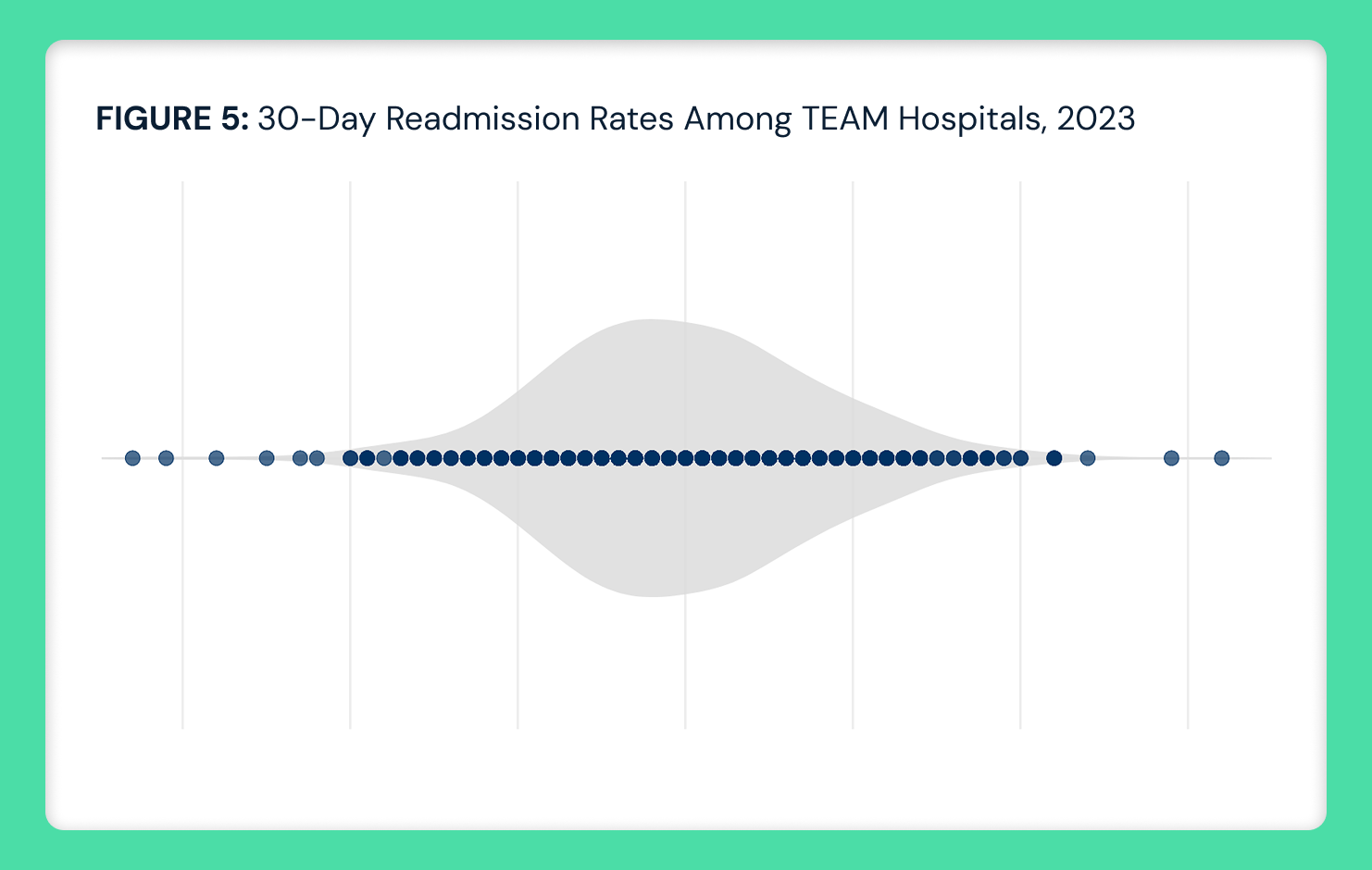

The most common chronic comorbid conditions among patients receiving dietitian and nutritionist services included musculoskeletal, metabolic and mental health diagnoses. The top five conditions were other joint disorders (43.1%), overweight and obesity (39.7%), back pain (39.0%), high blood pressure (36.1%) and unspecified soft tissue disorders (35.0%) (Figure 5). Metabolic conditions such as lipid disorders (33.4%) and type 2 diabetes (32.6%) were also prevalent. Mental health-related diagnoses were also common, including anxiety disorders (24.0%), sleep disorders (24.7%), stress and adjustment disorders (17.0%) and major depression (14.2%).

Conclusion

Despite consistent growth in patient volume over the past few years and growing insurance coverage, the integration of nutritionists and dietitians with traditional care delivery remains uneven across patient populations and clinical settings. While virtually enabled platforms like Nourish have demonstrated how dietitian services can be scaled rapidly through payer-aligned care models, the uneven adoption of nutrition services is, like many high-value clinical services, attributable to characteristically unpredictable reimbursement in healthcare.

Utilization has risen fastest among women under age 50, with limited uptake among older adults and men, even as metabolic and musculoskeletal comorbidities remain prevalent and increase with age. The increase in nutritionist service utilization coincides with the rise in telehealth beginning in 2020, suggesting that the shift toward virtual care may have influenced how and when patients engage with nutrition services.

Notably, clinical adoption has outpaced Medicare reimbursement parameters, which continue to restrict access primarily to patients with diabetes or kidney disease. As dietitians increasingly serve as complements to pharmacologic interventions for obesity and diabetes, such reimbursement constraints may limit broader adoption.

Additionally, despite comparable obesity prevalence between men and women, and only a modestly higher rate of multiple chronic conditions among women, nutritionist services remain markedly underutilized by men.9,10 This disparity in utilization suggests that factors beyond clinical need – such as referral patterns, awareness or perceived relevance – may contribute to gender differences in access to or engagement with nutritional care.

For all the talk about the importance of health and wellness, data suggests that health economy stakeholders view nutrition as an ancillary service instead of as the cornerstone of chronic disease prevention and management. While increasing utilization of a high value clinical service is encouraging, the proportion of patients accessing nutrition services remains small relative to the number of individuals who could benefit from them. Given that nearly three-quarters of U.S. adults are overweight and more than 40% are obese – with cardiovascular disease remaining the nation’s leading cause of death – the underutilization of nutrition services is a missed opportunity to improve overall health in the U.S. and reduce healthcare spending.11 The question for every health economy stakeholder is what keeps them from investing in obvious solutions to promote the health of every American.

- Studies

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)